The cost of paper is a substantial expense in the printing industry. This resource has had volatile pricing. During the pandemic, shortages arose, and demand increased. Since then, overall paper needs have shrunk, including every paper use case, from those used in mailing to consumer products. So, what trends will next impact paper prices?

The cost of paper is a substantial expense in the printing industry. This resource has had volatile pricing. During the pandemic, shortages arose, and demand increased. Since then, overall paper needs have shrunk, including every paper use case, from those used in mailing to consumer products. So, what trends will next impact paper prices?

Print and Mail May Have Decreased, But Not Costs

Your business has specific requirements to print and mail customer communications that fall into the transactional category — invoices, claims, statements, letters, and more. Even if you’ve seen an increase in electronic delivery, you still have a subset of print and mail.

You’d expect to see costs fall, but requiring less doesn’t lead to decreased paper prices. You may pay more for a ream because you don’t have the luxury of buying in bulk. The only way to achieve a better rate is by volume, which typically only professional printers have.

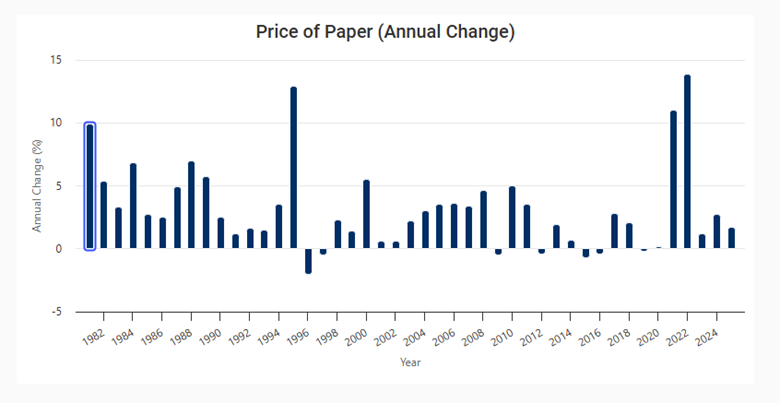

Annual Paper Price Trends

While 2021 and 2022 delivered the biggest spikes in paper pricing, the years following still had increases.

Inflation was a factor in the price hikes in the past two years, and experts believe this could continue in 2025. From the above chart, the price of paper is expected to increase by 1.7%.

However, many factors influence paper prices that are unpredictable or have yet to fully play out, including:

- Raw material scarcity

- Energy costs

- Supply chain disruptions or problems

- Environment and other regulations

- Labor shortages

- Tariffs from imported paper

Overall Demand Is Declining

The demand for paper products is decreasing across the world, in general. Typically, less demand equals a price increase pause. It’s too soon to forecast average costs for the year because of the influencing factors.

A demand decline doesn’t necessarily drive paper prices down. It could prompt production to slow, which could then affect the market if buyers fear scarcity.

Resource Availability Impacts Paper Pricing

Paper is the product of a natural resource that is somewhat finite. One concern in the market is natural disasters impacting timber supply, including wildfires and hurricanes. These events have been on the rise and will continue.

Paper is the product of a natural resource that is somewhat finite. One concern in the market is natural disasters impacting timber supply, including wildfires and hurricanes. These events have been on the rise and will continue.

Availability could also face snags as there could be competition for resources. Lots of rebuilding needs to occur in many parts of the country and the world. Wood is a necessity for this. This influx of demand could force pricing increases.

Softwood Pulp Outlook

A key component of paper costs is the softwood pulp market. The primary drivers of its cost are parallel to those described above, as well as alternative material availability and overall global economics.

Some trends that could influence softwood pulp prices include:

- Potential price stability, depending on supply, demand, and availability

- Environmental pressures in some areas where paper production is rampant

Those companies producing paper products must be agile and ready to address foreseen and unforeseen challenges. Advancements in pulp and paper technology could minimize these factors. With efficient, consistent production, there’s less waste.

How PCI Group Receives the Best Paper Prices

Our most significant advantage is the ability to purchase at high volume. Additionally, we have a diverse supply chain and never depend on a single vendor for the material. The supplier relationships and contracts we have guarantee and lock-in rates.

Our production methods use large reams of white paper which feed into printers. It’s called the White Paper Factory, and it ensures little to no waste. With this approach, we maximize the resource.

Managing transactional print and mail in-house will continue to raise costs associated with paper, equipment, technology, labor, and operational expenses. By working with us, the volatility of all these costs is much more controlled, meaning you feel less impact.

Get in touch today to see how we can reduce your overall print and mail costs.