Raw material costs continue to rise due to supply chain issues and the COVID-19 pandemic. Demand is high, and supply is still catching up. The material that’s critical to transactional print and mail that’s most in flux is paper. Paper prices increased 6-15% in 2021, so what does the future hold for paper market trends?

What the Experts Say About Paper Market Projections for 2022

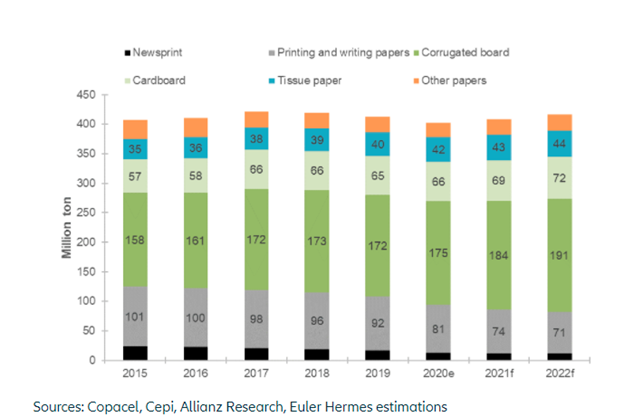

The expected amount of paper production globally in 2022 is 416mn tons. That number is lower than the peak of 2018 but greater than 2021. The catch-up is the result of Asia catching up with output lag. According to experts, North America could fully recover in 2022, adding +3mn tons.

Currently, China is the largest producer of pulp and paper, followed by the U.S.

Regarding printing paper, the output is declining. The output market share for this class was 31% in 2015, compared to 26% in 2019. That decrease is in part due to digitization and less printing as well as remote working. However, the analysis doesn’t mention any falloffs in print and mail.

Pulp Prices Still Trending Up

The core raw material for paper is pulp. Its costs increased sharply in 2021, and 2022 projections show a slight decrease. In September 2021, European pulp was up by 53%, and Asian pulp rose by 47%.

Pulp price increases hit the paper market hard. The good news is that it’s not suffering from labor shortages or significant equipment shortages.

Paper Market Trends: The Year Ahead

According to the data, production is catching up, but costs remain higher than pre-pandemic. The scarcity of products also appears to be leveling out. Except there are still many unknowns about 2022 regarding the newest variant of the COVID-19 virus and how it might disrupt production and supply chains.

So, what else is making the paper market so volatile? And how does that impact transactional print and mail?

More Packaging for E-Commerce Shifts Production

More Packaging for E-Commerce Shifts Production

E-commerce acceleration is not slowing down. While some consumers were hesitant to shop online, the pandemic changed that. Now that people are comfortable using this channel, they’ll continue to use it. That means more parcels shipped and a higher demand for cardboard and related paper products. If there’s only a finite amount of pulp, manufacturers will grow this category (as seen in the chart above).

Increase in Recyclable Products

More companies are committed to sustainability. They are demanding recyclable products, so that’s changing paper production. Recyclable products can be more expensive, but they are reusable, which is an overall good thing for the industry and planet.

Availability Volatility Is Still a Concern

While the market is rebounding, availability is likely to linger. The best way to mitigate this is to achieve as little waste as possible. Printers can accomplish this by having controls in place and working within the Lean Manufacturing framework.

Additionally, maximizing the usage of the material is key. For example, if you currently use inserts in your statements, that’s additional paper that you could remove from the process by using a White Paper Factory (WPF) approach that dynamically prints messaging on the statement.

Will Paper Market Trends Impact Your Bottom Line?

Printing and mailing transactional letters will always be part of customer communications. With paper prices increasing, running your own operation may no longer be fiscally viable. It may be time to seek an outsourcing partner that can decrease your costs while providing high-quality, compliant mailings.

A transactional printer like PCI Group has advantages in the paper market. Our contracts with paper vendors allocate a specific amount of their production. With this in place, we aren’t constantly looking for new providers. We print at least 1.5 billion pieces of paper each year and do so with less than 2% waste. We also use the WPF method, printing everything together with no need to pre-print.

If you’re concerned that the paper market will capsize your budget or leave you without sufficient materials, let’s talk about how we can revolutionize the way you produce transactional mail.